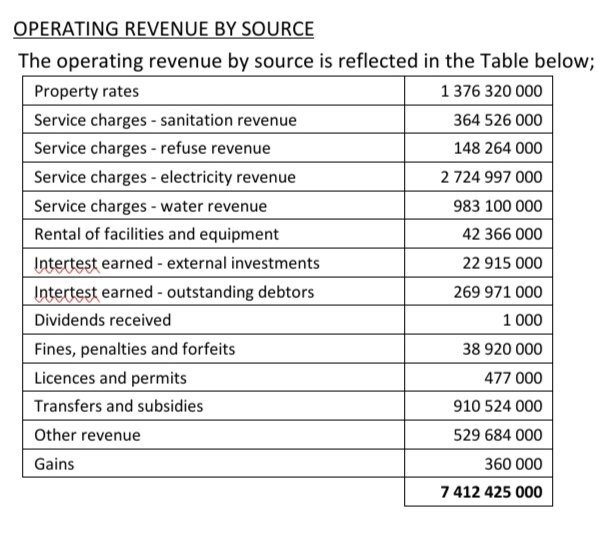

Below are the proposed tariffs in the Draft Budget MTREF 2020/21

Property rates and sanitation services are both calculated by applying a tariff to the valuation of the property.

For the past few years the DA constantly pointed out that these tariffs are not calculated correctly and as a result of that ratepayers are over taxed.

This tariff calculation should render a final real income that is very close to the budgeted amount that we know out of experience

To illustrate this point: For the present financial year as at 30 April the amount billed for the 10 months amounted to R1 109 951 that is R54.5 million more than the YTD budget. This as well as the fact that the metro do not have the reserves to assist here as relief for the hardship caused by COVID-19 epidemic is more than enough reason and motivation to approve a 0% increase for rates and sanitation. The loss in budgeted income is R161.7 million. This amount can easily covered by savings on the budget that the DA will propose later in this report (analysis.)

Water tariffs. It was reported in the Section 80 Committee Finance that the increase is based on an expected Bloemwater increase of 9% and that that might still be reduced. The DA acknowledges that water consumption can be used to curb usage because this is a scarce source. But because access to water is a basic right it should be more lenient on lower consumption than higher consumption

The loss as a result of water leakages is a big cost factor for which must be covered by the users who pay their accounts.

This fact is mentioned in the draft budget as in all the previous years but what we need now is a plan and action to stop this. A good start will be to repair reported leakages urgently.

Waste removal tariffs. This together with rates burden is a big risk for this metro. Frustration is building up amongst ratepayers and more and more voices are heard in favour of a rates boycott. This service is presently handled on a damage control basis and not a structured sustainable basis. The workers in this section should realise that, by bad service delivery and excessive pay demands, they will draw everybody down with when there is not enough money to pay the salaries of all employees. That day is closer than what they think.

All residential properties with a market value of R80 000 or less are exempted from paying refuse removal charges. The result of this is that about 70 000 households get this service for free. It is financed from the equitable share so that there is no real cost factor (R225.573 million) for those that pay for the service. It is, however, important that the equitable share cover the cost of delivering the service in the relevant cases.

Electricity Tariffs. In the Draft Budget it is recommended that the electricity tariffs be increased with 4.6% (on average) above the previous year….. This the only information available in the Draft Budget and because there is no reference to the detailed tariffs it is not possible to comment on this because many variation can appear in the “on average” reference

A further very important point regarding Centlec is that the Executive Mayor failed to comply with section 87 of the Municipal Finance Management Act Centlec should have submitted their budget to the parent municipality before the end of January and more important is section 86 (3) that states: “The mayor of the parent municipality must table the proposed budget of the municipal entity (Centlec) in the council when the annual budget of the municipality for the relevant year is tabled” The mayor failed to do so. The act further states that the Municipal Manager must immediately after the budgets were tabled make it public in the prescribed manner to allow the public to make inputs. Because the Centlec budget was not the public are denied the opportunity make inputs on that budget.

Analysis by DA Mangaung Cllr Hans Britz

Our proposals:

The DA shows that it is possible to reduce the tariff increases for Rates and Sanitation

to zero: This document shows that it is possible to balance this budget while providing much

needed rates and tariffs relief and economic stimulus by not increasing property rates and

sanitation tariffs. This can be done without impacting on the delivery of basic services, by

“cutting the fat” from a number of votes and line items that do not relate directly to service

delivery and improving efficiency. Mangaung metro must, amongst others:

a. Employee costs

i. Table a concrete plan on how to rectify the very high allocation to employee

related cost. This increased with R640m from 2016 to a total of R2 bn

ii. Correct the zero allocation of budget resources to overtime with a plan on how

to manage it. There are unavoidable emergencies like burst pipes that need to

be attended to, but the current actual expenditure of R150m on overtime is

expedient. To date the executive mayor has spent R5.4 million on overtime and

Waste and Fleet R53 million.

iii. Issues that need to be taken into account include:

- The perception that political offices have inflated staff compliments

especially since 2016. - Alleged excessive overtime claims for any non-service delivery, non-core

or managerial posts. - The salary bill provides for: A R3, 09 million salary package for the

municipal manager R2, 743 million for the chief of Finance. Between R2,

5 million and R3, 09 million for the heads of departments. R1, 604 million

and R1, 305 million for the mayor and speaker. A further R1, 232 million

for the chief whip and R1, 35 million for the deputy mayor. While these

salaries might be warranted in a well-functioning metro with a solid

revenue base, proper debt collection and cash flow management, the

current state of the metro does not warrant the current office bearers to

get these salaries. - The salaries of the administrators and their support staff are not

indicated in the budget.

b. Debt management

i. The loss of about R163 million from zero rates and sanitation tariff increases

can be recovered by reducing the provision for debt impairment with the same

amount

ii. This can be countered by making a decision to collect all outstanding

Government debtors in the 2020/21 financial year. (R1.53billion)

iii. Revisiting the use of inefficient Debt Collection contractors (costing R36m) to

collect outstanding debtors. This can be done more successfully in-house at a

lower cost.

iv. Replacing all rotating water meters with pre-paid meters to reduce the growing

water debt

c. Other costs

i. Reconsider the allocation of budget resources to Votes using the Vote of the

Executive Mayor as a starting point

ii. Give clarity on the value of the list of Cost Containment measures by releasing

details of savings envisaged.

iii. Develop a plan how to reduce water losses. It doesn’t help to say we are going

to reduce it, submit a plan that can be monitored.

iv. Non-core spending: All funding for non-core municipal programs such as

mayoral and speaker legacy/prestige programs, event sponsorships, the

habitual millions of rands tenders for voter education just before the elections

and catering should be cancelled.

v. Travel: All funding for extensive international travel for public office bearers and

officials should be cancelled

d. Maximizing revenue:

i. Social services, metro police and planning departments must pull up their socks

and with immediate effect ensure they start cover more of their departmental

expenditure by issuing and collecting fines and penalties for traffic, law

enforcement, building, dumping and planning violations. This could potentially

earn the city more than R100m in revenue. If the mayor, City Manager and

heads of department continue to prove they are not up to the task, they must

leave. In 2019/20 council illegally attempted to write off R200 m in uncollected

traffic fines due to departmental failures. Not only is this illegal, but it shows the

continued lost opportunities for raising revenue if the department functions.

- Service delivery failures must be addressed to reduce the risk of taxpayer revolt and

boost economic recovery.

a. A major issue for businesses and residents alike is the lacking basic service delivery

such as water, electricity, streetlights, sanitation, refuse removal, grass cutting, tree

cutting, fixing of potholes and opening blocked storm water pipes and inlets.

b. The city has been failing residents in the provision of all these services, while the call

centers do not function properly. The risk of a rates revolt by residents is growing

continually as service delivery becomes more erratic.

c. Mangaung must, amongst others: Submit a waste removal plan detailing how this

service will be rendered on a sustainable basis. The erratic and crisis based

management at the moment is creating a massive risk for rates revolt which could

ultimately lead to the inability to pay salaries of all workers.

Capital Budget: Develop a greater urgency to execute the capital budget with measurable

progress parameters. With 1 month left, less than 40% of the capital budget has been spent.

This while the mayor has conceded in the NCOP that Mangaung uses capital grants to pay

salaries.

Vehicles: The budget provides for R87m in capital expenditure for “other vehicles”

through lease financing of the same amount, the biggest single expense. Any funding

for the purchase of official vehicles for political office bearers such as Executive

Mayors/MMCs/Speakers as well as for the personal use of Municipal Managers and

Directors should be prohibited. The only vehicle purchases to be considered should be

for the support of service delivery, such as refuse collection compactor trucks, tractors,

Fire, Sanitation, Water and roads team trucks and only if absolutely required.

Furthermore, the structure of this massive tender is designed to limit the number of

possible companies that can tender, as it combines a number of different industries.

This tender could rather be split up so that competitive bidding can ensure efficient use

of resources. I.e. refuse compactor trucks, trucks for service delivery, vehicle lease

agreements, smaller vehicles etc.

The same goes for massive IPTN projects that should be broken up in order to allow

local businesses to directly compete for smaller parts of the work. IPTN tenders and

sub tenders should also be advertised and fairly awarded

Centlec and Bloemwater tariffs should not be increased in excess of the increase of the bulk

cost from Eskom and Bloemwater:

Indicate what steps will be taken for non-compliance regarding the Centlec Budget